Powered by cleartax

Claim your TDS refund

with up to 60% discount

No matter which app you use, the offer is applicable for all online rummy players

Scan this QR to download RummyCulture app

Claim your TDS refund with up to 60% discount

Powered by cleartax

Exclusive offers

Pro

TDS >= ₹1,000

ClearTax discount

Up to 60%

Discount Credits refund

100%

Basic

TDS < ₹1,000

ClearTax discount

Up to 60%

Discount Credits refund

0%

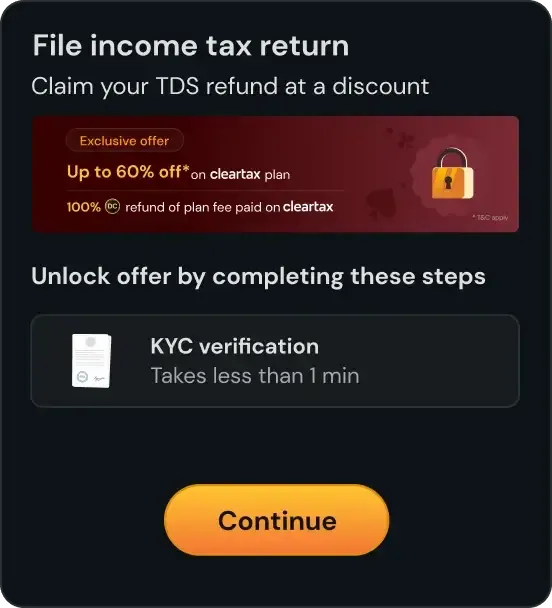

How to avail the offer?

1

Step

Download the RummyCulture app and register with your mobile number

2

Step

Verify your KYC details to unlock the offer

3

Step

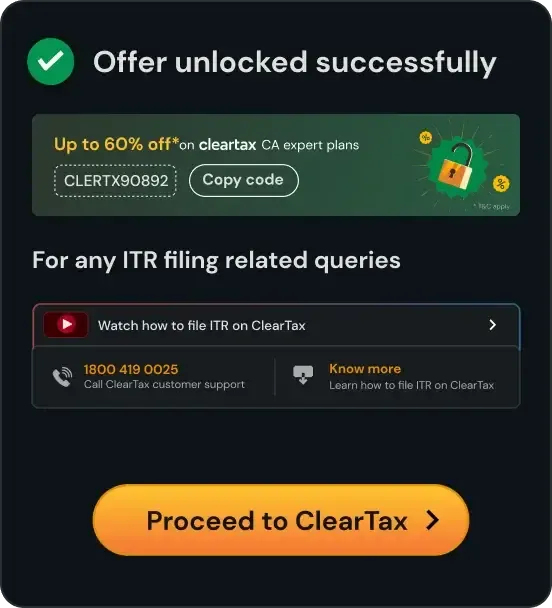

Claim your offer on ClearTax

4

Step

Complete your ITR filing to get the refund

Frequently asked questions

To file your TDS online

1. You have to first register yourself on the IT department’s website: https://www.incometax.gov.in/iec/foportal/.

2. Pre-validate the bank details by entering the bank account number and IFSC and nominate the bank account for refund.

3. After registration, you can file your income tax return by downloading the relevant ITR form.

4. Fill in the relavant details, upload the Form and click on submit.

otherwise,

We have associated with ClearTax to help you file the income tax returns and claim your TDS refunds. You can go to the <x section> on our app to access the Clear Tax Portal and proceed with filing your returns

Every assessment year, you are required to file your tax returns by July 31. However, the earlier you start your income tax filing process, the sooner you can get the excess Tax money reversal or tax claim.

You would need the Account Statements and TDS Certificates of the corresponding financial year inorder to start your filing Income Tax Filing returns. These documents are available in your RummyCulture application under the 'TDS & Invoices' section, inside your profile

You are requested to submit the account statements and TDS certificates of the corresponding financial year from all the platforms in which you engage in gameplay. In order to know more we would recommend you to get in touch with the Clear Tax customer support who can assit you further!

We would recommend that you talk to the Clear Tax customer support at 080674 58777, they would have the right expertise to help you with your queries

or

We would recommend you to visit <x section> of our app where you can view the customer support contact details of Clear Tax, who have the right expertise to help you with your queries

We would recommend that you talk to the Clear Tax customer support at 080674 58777, they would have the right expertise to help you with your queries

or

We would recommend you to visit <x section> of our app where you can view the customer support contact details of Clear Tax, who have the right expertise to help you with your queries

You must provide true, accurate, current and complete information at the time of filing your income tax returns. We recommend that you get in touch with Clear Tax customer support to help you futher regarding this.

Tax refunds are initiated by the tax department once you have e-verified your return

1. Typically, it takes 4-5 weeks for the refund to be deposited in your bank account

2. If the refund is not received within this timeframe, you should consider these steps:

2.1. Check intimation for any discrepancies or errors in your ITR (Log in to e-filing portal > e-File > Income Tax Returns > View filed returns)

2.2. Check your email for notifications from the Income Tax (IT) department regarding the status of the refund.

To know more we request you to contact Clear Tax Customer Support at 080674 58777

This offer can be availed by all Rummy players. For availaing the offer player need to be registered on RummyCulture & post registration player will be able to proceed for ITR filling & avail the offer.

Yes, you can avail this offer if you are playing on Multiple Rummy apps. This offer is available for registered RummyCulture players. If, plyare is playing on other apps also alogn with RummyCulture, they can avail the offer.

This offer is available for all registered players on RummyCulture. Add cash or deposit is not required for availing the offer.

This offer can be availed by all RummyCulture registered players. Once the ITR is filed on ClearTax & you have processed the payment, you will get the Discount Credit for equivalent amount in your DC account, which can be fully used to play games on RummyCulture.

Step 1 - Visit official Income tax efilling website - https://www.incometax.gov.in/iec/foportal/; Step 2 - Login either PAN or Aadhar number and click on 'Continue. Step 3 - Select "Income Tax Returns" from e-file. Step 4 - click on 'View Form 26AS' and Select 'Confirm' next. Step 5 - click on 'View Tax Credit (Form 26AS)'; Step 6 - Select the 'Assessment Year' and format you need to view Form 26AS. Step 7 - enter the ‘Verification Code’ and click on the ‘View/ Download’ button.

On RummyCulture, Form 16 is available in your RummyCulture application under the 'TDS & Invoices' section, inside your profile. Other Rummy app players need to contact their custoomer care for getting Form 16 for financial year 2023-24.

Post going on Cleartax website, you have option to choose Assisted filing. Post filing the details & processing the payment, account manager will be assigned within 30 Minutes & assisted filing process will start.

File for TDS refund at a discount!

Good news for all RummyCulture players! We have partnered with ClearTax to enable you to file your ITR (Income Tax Return) for the financial year 2023-2024 through Clear Tax at a discount discount.

Benefits you get with this partnership:

Free self filing: Self filing ITR is free for all RummyCulture registered players on ClearTax. All you need to do is register on RummyCulture, fill in your details and proceed for ITR filing on the ClearTax website. TnCs Apply.

Discounted filing with CA assistance: If you need any assistance from a Chartered Accountant (CA), you can get one on ClearTax. Users registered with RummyCulture get an exclusive discount if they create a ClearTax account through the RummyCulture app. TnCs Apply.

What is TDS?

Tax Deducted at Source (TDS) is the amount that is deducted from a certain payment. It helps the government prevent tax evasion by collecting it at the time of payment. In case of real-money games, it is the amount that is deducted on your net winnings at the time of withdrawals.

Provisions for taxation and TDS on winnings from online rummy the said date:

Currently, 30% TDS is charged on your net winnings in real-money gaming including online rummy. This tax is only deducted when you are withdrawing your winnings from an online gaming platform. Also, 28% GST is applicable on all deposits made by an individual on an online gaming platform. All these taxes go straight to the government. All real cash rummy players should be well versed with TDS Policy and GST Policy for online rummy.

What is section 115BBJ?

Winnings from any online game shall be charged to tax under this section of the Income Tax Act, 1961.

● 30% tax is charged at the time of withdrawals on your net winnings.

● The section was applicable from 1st April, 2023, i.e., any income from online games from the said date shall be taxable under this section.

What is section 194BA?

Any person responsible for paying to any person any income by way of winnings from any online game during the financial year shall deduct income-tax on the net winnings in his user account under the said section of Income Tax Act, 1961.

● The applicable rate of TDS shall be 30% at the time of withdrawal (without any threshold) of such winning amount.

● “Any Person” here means the one making payments of winnings or online gaming intermediary.

● “Net Winnings” is A – (B + C), where A is the withdrawal amount, B is the sum of all non-tax deposits made by the user until the time of withdrawal and C is the opening balance at the beginning of a financial year.

● “User Account” means a user who has registered with an online gaming intermediary, delivering one or more online games.

● The section was applicable from 1st July, 2023, i.e., tax shall be deducted from any income from online games from the said date.